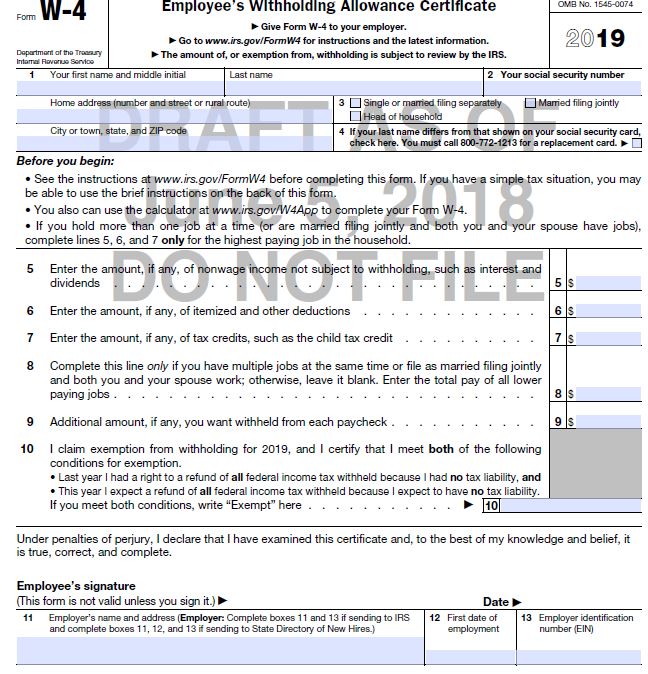

The new Form W-4?

As

the year continues there are more drafts of tax forms being released by the

IRS. As a result of the Tax Cuts and Jobs Act, the most extensive change to the

tax code in 30 years, many forms are being redesigned and will have a new look

for the 2018 filing season. At this point there is nothing official, but these

previews give us an idea of what practical impact tax reform will bring.

At

first glance, it looks like Form W-4 will be simpler. It reflects the focus

that has now been placed on tax credits and different kinds of financial

contributions. Many are difficult to forecast at the beginning of the year.

Many Taxpayers are unsure of what tax credits they may qualify for. At this

point, the only way to give accurate responses in these areas is to fill out up

to 11 separate worksheets.

These along with other massive changes will more than likely change some

responsibilities between Taxpayers and Employers. As it stands now, Employers

will need to calculate the correct withholding amount. This can put a burden on

Small Businesses and may lead to the outsourcing of payroll and accounting as

the best option. At this point, what we have is a draft, and it can be changed.

Reach out to a Qualified Tax Professional you trust to help you understand how

Tax Reform will affect you.

Comments

Post a Comment